That means the second core on the original Core Duo CPU provides about one-third more power.īy way of comparison, the G4 Mac mini offered a lot less horsepower. There’s an 11% difference in clock speed between 1.5 GHz and 1.66 GHz, and we anticipate a 1.5 GHz Core Duo would benchmark at roughly 1960.

The 1.66 GHz Mac mini scores 2136, and the newer 1.83 GHz mini scores 2312, an 8.3% improvement (just a bit less than the 10% difference in clock speed). One step higher, from the 1.5 GHz Solo to a 1.66 GHz Duo, boosts the benchmark score by 50%. This is the only Mac ever released with a Core Solo CPU, and it really does make a difference. Even the least powerful Intel-based Mac ever released, the Core Solo version of the Early 2006 Mac mini, outperformed it with a score of 1472 (just under 1000 points per GHz).

The baseline score of 1000 is based on performance of a 1.6 GHz single processor Power Mac G5. Let’s see if the numbers really bear that out. The only big changes occur at the low end with the (discontinued) single-core Mac mini, or at the high end with the quad-core Mac Pro.”

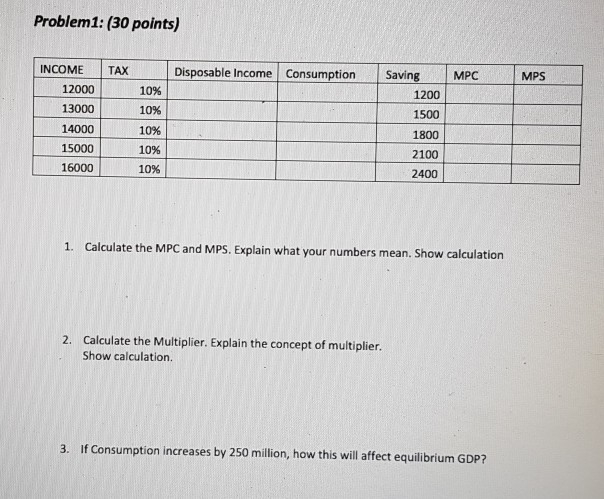

#WHAT DOES MPC 2 STAND FOR AND MULTPLIER 2 PRO#

“There’s not a huge change in performance across most of Apple’s Intel-based Mac lineup (the high-end MacBook Pro Core 2 Duo is only 30% faster than the low-end MacBook Core Duo, for example). Geekbench 2 is designed to measure CPU and memory performance, not graphics, an area where the Mac mini, MacBook, and entry-level iMac fall behind the rest of the pack with their integrated Intel GMA 950 graphics. Summary Definitionĭefine Money Multiplier: Monetary multiplier means the influence a central bank has over the money supply by altering the required banking reserve rate.How do the Intel Core Solo, Core Duo, Core 2, and new quad-core CPUs compare? That’s the question Primate Labs addresses in their latest Geekbench Comparison. This drastically reduces the effect on The Fed, and shows how important banks are to the circulation of money in the economy. This means that in order to stimulate the economy by $5,000,000,000 then The Fed only needs to invest $500,000,000. This means that the Federal Reserve needs to inject ($5,000,000,000 x 0.7) = $3,500,000,000.Ĭonversely, if the FED reduces the reserve requirement to 10%, the money multiplier is 1 / (.1) = 10. According to this, if the economy needs $5,000,000,000 and the current reserve requirement is 70%, the monetary multiplier is only 1 /. This is because the money multiplier formula is calculated as Deposits divided by Reserve Requirement. This drastically decreases the potential for investment, and the economists know that if they lower the banks’ reserves requirements, they will loan out more money. This means that the banks lend out only 30% of their funds, and hold the rest. What are the Fed’s tools to stimulate the economy?įirst, they look to the percent of reserves that banks are holding currently: 70%. The economists meet and eventually decide that the economy needs $5,000,000,000 in order to stimulate investment and economic growth.

He decides to conduct an investigation into how much money the economy needs to begin to turn around and tasks his economists with deciding how much stimulus the Federal Reserve should distribute. Benjamin is the head of the Federal Reserve, and the United States is a few years into one of the most devastating recessions in its history.

0 kommentar(er)

0 kommentar(er)